The National Audit Office (NAO) is an independent public body established by the Constitution of the Republic of Mauritius. The Director of Audit is the head of the NAO and his appointment, independence, security of tenure, as well as his authority are spelt out in the Constitution while his duties and powers are laid down in the Finance and Audit Act.

In the international forum, NAO is referred to as the Supreme Audit Institution (SAI) of Mauritius. SAIs around the world are affiliated to the International Organisation of Supreme Audit Institutions (INTOSAI), an autonomous, independent and non-political organisation, which operates as an umbrella organisation for the external government audit community.

NAO forms an integral part of the governance system of Mauritius, promoting accountability, transparency and contributing to the improvement in the management of public funds. Public sector entities are accountable to the National Assembly for the use of public resources and powers conferred on them.

It is the responsibility of NAO to give independent assurance to the National Assembly and other oversight bodies that the public sector entities are operating and accounting for their performance in accordance with the purpose intended by the National Assembly. NAO, thus, plays a vital role in the accountability cycle.

The demand for public accountability on the part of the persons or entities managing public resources has become increasingly prominent over the years, such that, there is greater need for the accountability process in place to operate effectively. In Mauritius, the key stakeholders exercising financial control over public resources are:

● National Assembly

● Government Executives (Accounting Officers)

● Accountant-General

● National Audit Office (Director of Audit)

● Public Accounts Committee

The part played by these stakeholders in the accountability process is briefly described below:

National Assembly

The only authority for the expenditure of public funds and for the raising of revenues by public bodies is that which is given by Parliament through the National Assembly. The National Assembly approves the Government Annual Estimates and this approval is given statutory force by the passing of an Appropriation Act each year, whereby the amount allocated for each Government service is set out under a series of “Votes”. Subsequently, the Appropriation Act is assented by the President of the Republic of Mauritius and gazetted.

Accounting Officers

The Accounting Officers of Ministries and Government Departments are mainly the Senior Chief Executives, Permanent Secretaries and Administrative Heads. They are responsible for the efficient and effective management of funds entrusted to them, the collection of revenues falling under their responsibility and the delivery of services, as well as for the maintenance of an effective accounting and internal control systems. As such, they are accountable to the National Assembly for the management of public resources and for the performance of their departments.

Accountant-General

The Accountant-General is the administrative head of the Treasury. He maintains the accounts of Government and ensures that accounting systems respond to Government’s needs for the proper processing, recording and accounting of financial transactions and for financial reporting. The Accountant-General prepares Annual Statements showing the financial transactions and financial position of the Republic of Mauritius and these are submitted to the Director of Audit. The statements give consolidated financial information on Ministries and Government Departments.

National Audit Office

NAO plays an important role in the accountability process, providing a key link between the Legislature and the Executive. NAO gives an independent assurance to the National Assembly that Government entities are operating and accounting for their performance in accordance with the National Assembly’s purpose. Statutory responsibilities and powers have thus been conferred to the Director of Audit to enable him to fulfil his obligations. NAO examines the Annual Statements of the Republic of Mauritius, as well as the underlying records. The audit function and the submission of annual Audit Reports to the National Assembly by NAO is the first step in the process of oversight. After the Audit Reports are tabled, other important mechanisms are in place to ensure proper accountability.

Public Accounts Committee

The Public Accounts Committee (PAC) represents Parliament and is one of the main stakeholders of the Report of the Director of Audit. It is a sessional Select Committee, appointed under the Standing Orders of the National Assembly, and consists of a Chairperson appointed by the Speaker and not more than nine members nominated by the Committee of Selection.

As per the Standing Orders, the function of the Committee is to examine the audited accounts showing the appropriation of the sums granted by the Assembly to meet the public expenditure and such other accounts laid before the Assembly as the Assembly may refer to the Committee together with the Director of Audit’s report thereon. The Committee has the power, in the exercise of its duties, to send for persons and records, to take evidence, and to report from time to time. Also, the Rodrigues Regional Assembly (RRA) Standing Orders provide for the setting up of a PAC comprising a Chairperson and not more than four other members to examine the audited accounts showing the appropriation of the sums granted by the Regional Assembly to meet the public expenditure and other accounts laid before the Assembly together with the Report of the Director of Audit thereon.

The Director of Audit has the responsibility to audit the accounts of:

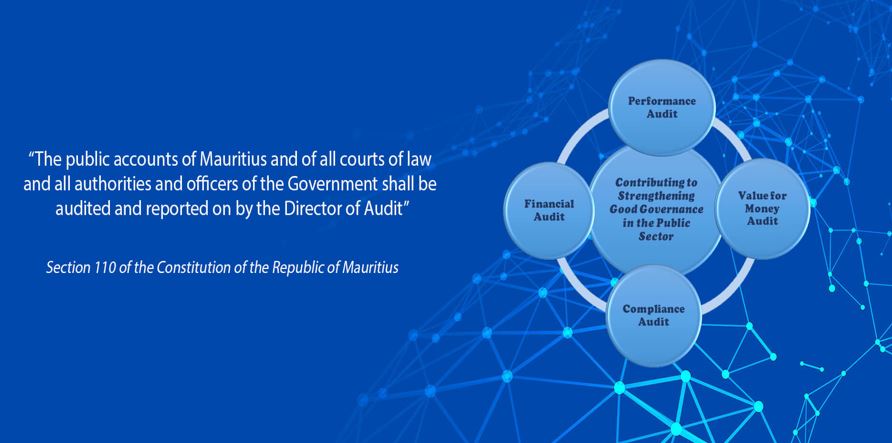

The NAO carries out two main types of audits, namely Regularity Audit and Performance Audit, to fulfill its audit mandate and to provide assurance to the National Assembly on the proper accounting and use of public resources. Regularity Audit encompasses Financial Audit, Compliance Audit and Value for Money Audit, and involves:

Performance audit embraces:

● Audit of the economy of administration in accordance with sound administrative principles and practices, and management policies;

The legal framework within which NAO exercises its public-sector audit function is spelt out, primarily, in the following legislations:

Constitution Section 110(2) provides that the public accounts of Mauritius and of all courts of law and all authorities and officers of the Government shall be audited and reported on by the Director of Audit. In the case of any body corporate directly established by law, the accounts of that body corporate shall be audited and reported on by the Director of Audit provided it is so prescribed. Section 110(3) provides that the Director of Audit shall submit his reports to the Minister responsible for the subject of Finance, who shall cause them to be laid before the National Assembly.

The duties of the Director of Audit are spelt out at Section 16 (1) of the Act. This subsection states that the Director of Audit shall satisfy himself –

(a) that all reasonable precautions have been and are taken to safeguard the collection of public money;

(b) that all laws, directions or instructions relating to public money have been and are duly observed;

(c) that all money appropriated or otherwise disbursed is applied to the purpose for which Parliament intended to provide and that the expenditure conforms to the authority which governs it;

(d) that adequate directions or instructions exist for the guidance of public officers entrusted with duties and functions connected with finance or storekeeping and that such directions or instructions have been and are duly observed; and

(e) that satisfactory management measures have been and are taken to ensure that resources are procured economically and utilised efficiently and effectively. Section 16(1A) further requires the Director of Audit to carry out Performance Audit and to report on the extent to which a Ministry, Department or Division is applying its resources and carrying out its operations economically, efficiently and effectively.

Section 16(2) provides that the Director of Audit shall not be required to undertake any examination of accounts partaking of the nature of a pre-audit and involving acceptance by him of responsibility which would preclude him from full criticism of any accounting transactions after those transactions have been duly recorded. Section 19 provides that the Accountant-General shall within six months of the close of every fiscal year, sign and submit to the Director of Audit statements presenting fairly the financial transactions and financial position of Government on the last day of such fiscal year.

For the Rodrigues Regional Assembly, the Commissioner responsible for the subject of Finance must submit the respective statements within three months of the close of every fiscal year. Section 20 provides that the Director of Audit shall send to the Minister (responsible for the subject of Finance) copies of the statements submitted in accordance with Section 19 together with a certificate of audit and a report upon his examination and audit of all accounts relating to public money, stamps, securities, stores and other property –

(a) of Government;

(b) of the Regional Assembly relating to the Island of Rodrigues, and the Minister shall as soon as possible thereafter lay those documents before the National Assembly.

The preparation of Financial Statements in respect of Special Funds and the audit thereof are regulated by the regulations (issued under the Finance and Audit Act) or such legislations under which such Special Funds are established.

Section 5 provides that every Board shall, every financial year, with the approval of the Minister to whom the responsibility for the statutory body concerned is assigned, appoint an auditor to audit the financial statements of the statutory body. This does not apply where the enactment establishing the statutory body provides that the Director of Audit shall audit its financial statements.

Section 7 provides that after approval by the Board (of a Statutory body), the chief executive officer shall, not later than four months after the end of every financial year, submit the annual report to the auditor. The Director of Audit shall, within six months of the date of receipt of the annual report, submit the annual report and his audit report to the Board.

Section 8 prescribes matters on which the Director of Audit should report. As per Section 8, the Director of Audit shall report to the Board whether –

(a) he has obtained all the information and explanations which to the best of his knowledge and belief were necessary for the purpose of the audit;

(b) in his opinion, to the best of his information and according to the explanations given to him, the financial statements give a true and fair view of the financial performance of the statutory body for the financial year and of its financial position at the end of the financial year;

(c) this Act and any directions of the Minister, in so far as they relate to the accounts, have been complied with;

(d) in his opinion, and, as far as could be ascertained from his examination of the financial statements submitted to him, any expenditure incurred is of an extravagant or wasteful nature, judged by normal commercial practice and prudence; and

(e) in his opinion, the statutory body has been applying its resources and carrying out its operations fairly and economically.

Section 9 provides that, on receipt of the annual report including the audited financial statements and the audit report, the Board shall, not later than one month from the date of receipt, furnish to the Minister to whom responsibility for the Statutory Body is assigned, such reports and financial statements. The latter shall, at the earliest available opportunity, lay a copy of the annual report and audited accounts of every statutory body before the National Assembly.

As per Section 136, the Chief Executive of every Local Authority, shall, within four months of the end of every financial year submit the approved financial statements to the Director of Audit.

As per Section 138, the Director of Audit shall address to the Minister (to whom responsibility for the subject of Local Government is assigned) and to the Local Authority concerned, a copy of the certified financial statements and his report on every Local Authority audited by him. Section 138 also prescribes matters on which the Director of Audit should report:

(1) The Director of Audit shall make a report to the Council on the financial statements which have been audited.

(2) The report shall state –

(a) the work done by him;

(b) the scope and limitations of the audit;

(c) whether he has obtained all information and explanations that he has required; (d) any item of account which, in his opinion, is contrary to law;

(e) any loss or deficiency which, in his opinion, is wholly or partly due to the negligence or misconduct of any person;

(f) any sum which, in his opinion, ought to have been so brought to account but which, due to willful default or negligence, has not been brought into account;

(g) any failure to recover any rate, fee or other charge in the manner specified in section 101;

(h) whether, in his opinion, the financial statements give a true and fair view of the matters to which they relate, and where they do not, the aspects in which they fail to do so, and whether the financial statements have been prepared in accordance with the Accounting Standards approved by the Minister to whom responsibility for the subject of finance is assigned.

(3) A report under subsection (1) shall state whether the instructions of the Minister, if any, in regard to the financial statements have been complied with.

Sections 138 and 139: The Local Authority shall consider the report of the Director of Audit at its next ordinary meeting or as soon as practicable thereafter and shall cause the certified financial statements and the report of the Director of Audit to be published in the Government Gazette within 14 days of their receipt by the Local Authority.

Section 42 of the Public Procurement Act provides that the auditor of every public body (in our case the Director of Audit) shall state in his annual report whether the provisions of Part V of the Act on the Bidding Process have been complied with.

NAO conducts its audits in accordance with International Standards of Supreme Audit Institutions (ISSAIs) except for the audit of State-Owned companies (assigned to the Director of Audit) which are carried out in accordance with International Standards of Auditing. The audit approach of the NAO may be summarised as follows:

(a) NAO adopts a risk based approach by which audit resources are directed towards those areas of the financial statements that are more likely to contain material misstatements as a consequence of the risks faced by the client. We identify and assess the risks of material misstatement, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. (ISSAI 1315 Identifying and assessing the Risks of Material Misstatements through Understanding the Entity and Its Environment; ISSAI 1330 The Auditor’s Responses to Assessed Risks)

(b) We do not test all transactions but use sampling methods to select transactions and balances for testing. It is not cost effective to seek absolute certainty and therefore we look for reasonable assurance. Additionally, examining all data may still not provide absolute certainty because some data may not have been recorded. Audit sampling enables us to obtain and evaluate audit evidence about some characteristics of the items selected in order to form or assist in forming a conclusion concerning the population from which the sample is drawn. (ISSAI 1530 Audit Sampling)

(c) The primary responsibility for the prevention and detection of fraud rests with both those charged with governance of the entity and management. Our objective as auditors is to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatements, whether due to fraud or error. Owing to the inherent limitations of an audit (e.g. Client may provide incomplete information or falsify documents and use of sampling by audit), there is an unavoidable risk that some material misstatements of the financial statements may not be detected, even though the audit is properly planned and performed in accordance with the standards. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Consequently, fraud might remain concealed to us even if a thorough audit is conducted. (ISSAI 1240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements)

(d) Similarly, the primary responsibility for preventing and detecting corruption rests with the administrative or law enforcement authorities, such as the Police and the Independent Commission Against Corruption.